A modern earnings

analysis platform.

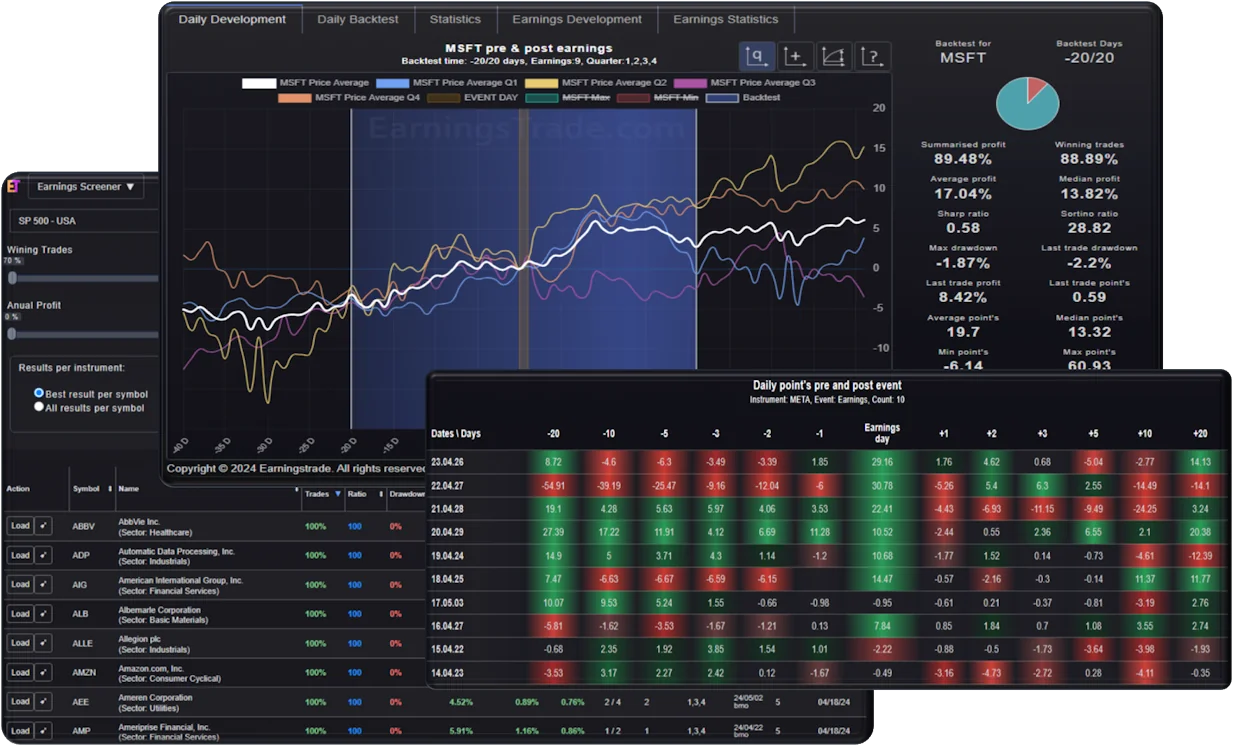

Discover the earning trades with very high hit rates and improve your trading record.

Effective Analysis

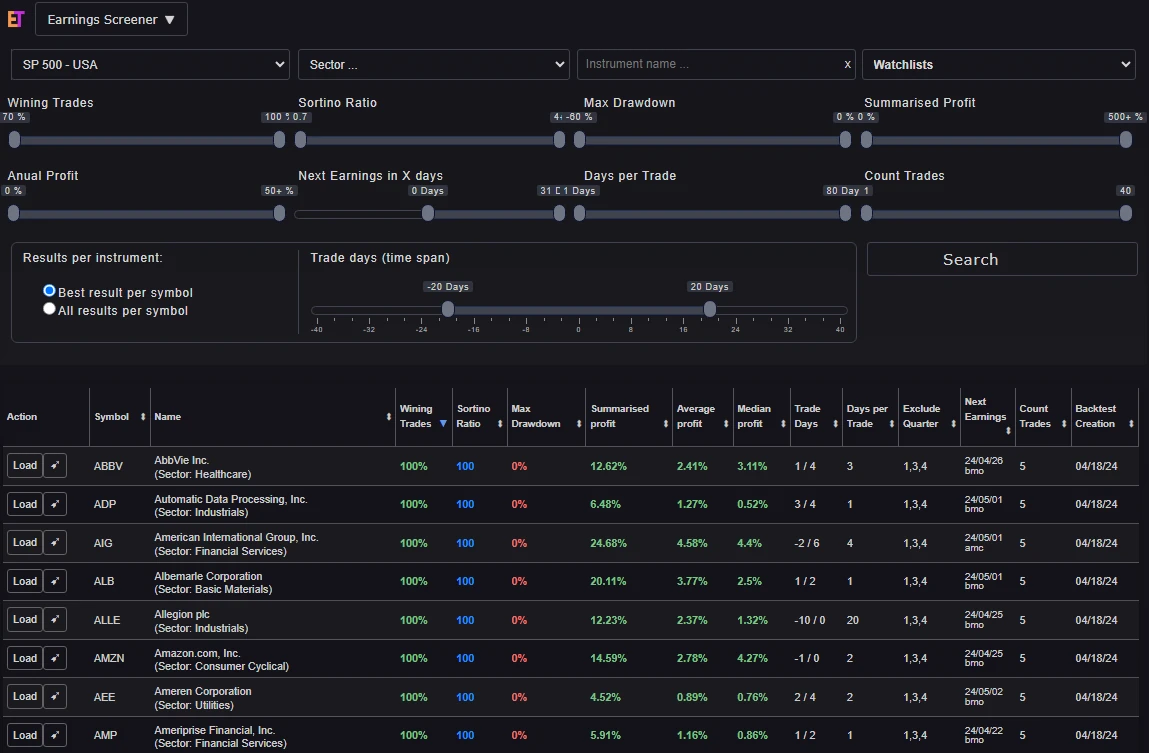

Powerfull Screener

Deep-dive Earnings-Analysis

Some trade examples

Stable & profitable Trading Results

Use trades with a hit rate of more than 90%

Less drawdowns in your portfolio

Recurring Price Patterns offer Very Good Entry and Exit Points

Hundreds of Trade and Investment Opportunities are stored for You in our database

Identifying trading and investment opportunities has never been easier

Create your own in-depth analysis

Analysis Tools for Your Success

Find recurring patterns with an hit rate of over 90%

Our screener shows you the best current entry opportunities in just one click. Hundreds of trading opportunities are stored in our database.

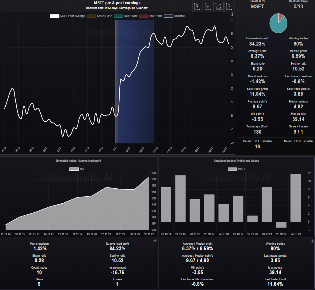

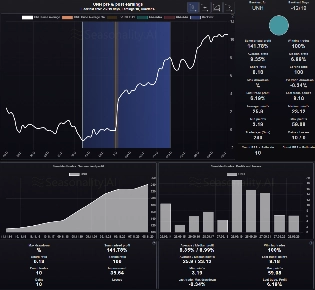

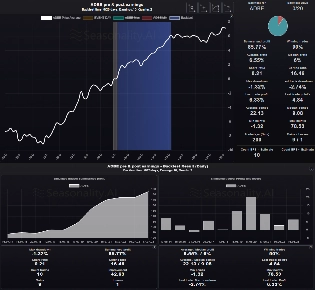

Analysis of the quality of the price movement of earnings announcements

Graphs, backtests and statistics show the quality of earnings price-patterns.

Capitalize on market movers

Maximize your profit potential and enjoy the benefits of a more statistical approach to day or swing trading.

What our customers say

Frequently Asked Questions

How can I find profitable earnings patterns?

Earningstrade offers the Earnings Screener

The Earnings screener is a tool that identifies earnings patterns in different indices.

Use the Screnner filter functions to customize the results according to your needs.

When do earnings patterns work best?

There are earnings patterns that work 100% over a more extended period. There is no guarantee that they will continue to work, but there is a high probability that they will continue to repeat.

Earnings patterns work best when the overall trend and market sentiment match the earnings pattern.

For example: The index should not be in a bear market for earnings long patterns in equities.

Get full access as a member!

Earningstrade.com

Identifying trading & investment opportunities has never been easier.